nebraska sales tax rate changes

Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up to 2. The sales tax rate was originally.

Sales Taxes In The United States Wikipedia

Sales and Use Tax.

. Nebraska Department of Revenue. Nebraska has a statewide sales tax rate of 55 which has been in place since 1967. Average Sales Tax With Local.

Make a Payment Only. New local sales and use taxes. In addition local sales and use taxes can be set at 05 1 15 175 or 2 as adopted by city or county governments.

800-742-7474 NE and IA. Request a Business Tax Payment Plan. Nebraska sales tax changes effective July 1 2019.

Over the past year there have been 22 local sales tax rate changes in Nebraska. This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the. The current state sales tax rate in Nebraska NE is 55 percent.

A new 15 local sales and use tax takes effect bringing the combined rate to 7. Coleridge Nehawka and Wauneta will each levy a new 1 local sales and use tax. Several local sales and use tax rate changes take effect in Nebraska on July 1 2019.

Several local sales and use tax rate changes will take effect in Nebraska on April 1 2019. A city or county may be added by writing the information in. Changes in Local Sales and Use Tax Rates Effective July 1 2021 No Changes in Local Sales and Use Tax Rates for October 1 2021 Publish Date.

The Nebraska state sales and use tax rate is 55. The Nebraska state sales and use tax rate is 55 055. Changes in Local Sales and Use Tax Rates Effective January 1 2021.

A new 1 local sales and use tax is being imposed in the. Sales tax data for Nebraska was collected from here. NE Sales Tax Calculator.

Nebraska Rate and Other Taxability Changes. The following are recent sales tax rate changes in Nebraska. City or county sales tax due by the retailer and the MMP less the city or county sales tax remitted by the MMP on the retailers behalf.

The Nebraska NE state sales tax rate is currently 55. This page allows you to browse all recent tax rate changes. Local sales tax rates changes occur quarterly and are published on our website 60 days in advance see E DU-96.

Notification of local sales tax rate changes will no longer be mailed. The total tax rate might be as high as 75 percent depending on individual municipalities however food and. Over the past year there have been 1096 local sales tax rate changes in states cities and counties across the United States.

A new 1 local sales and use tax takes effect bringing the combined rate. Sales Tax Rate Finder. Nebraska sales tax details.

Coleridge Nehawka and Wauneta will each levy a new. Beginning October 1 2002 Nebraska will have several alterations to their sales and use tax system. Depending on local municipalities the total tax rate can be as high as 75 but food and prescription.

55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska. Several local sales and use tax rate changes will take effect in Nebraska on July 1 2019. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska.

Printable PDF Nebraska Sales Tax Datasheet.

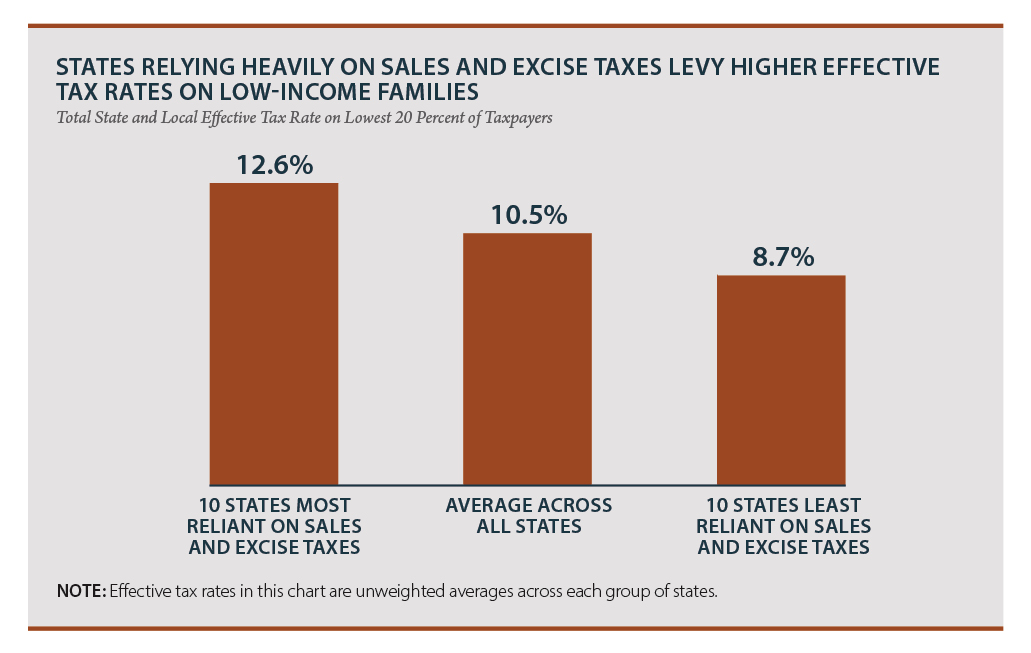

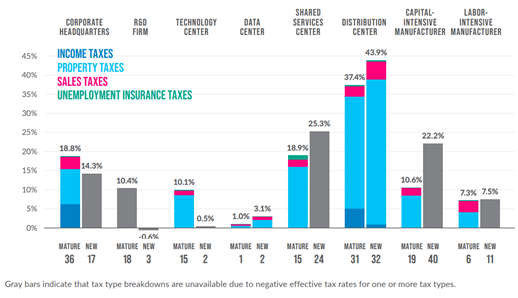

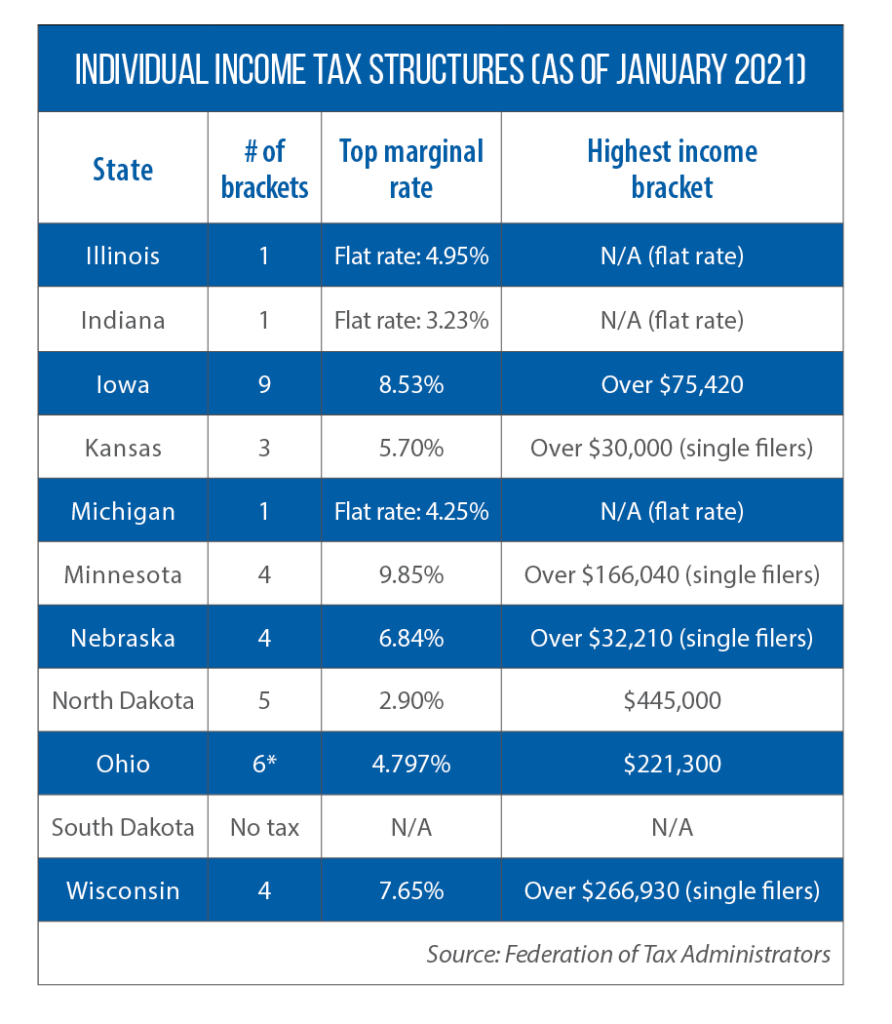

A Twenty First Century Tax Code For Nebraska Tax Foundation

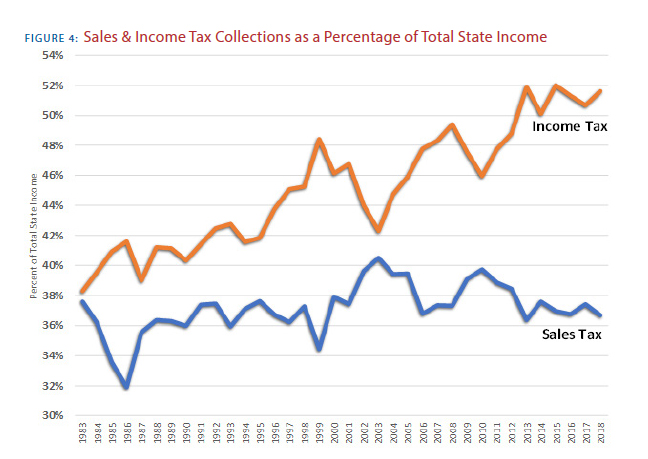

Taxes And Spending In Nebraska

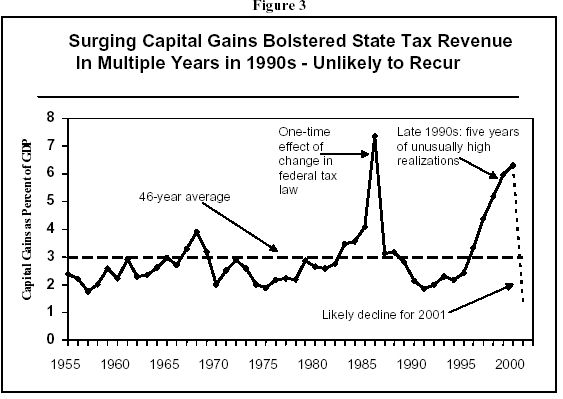

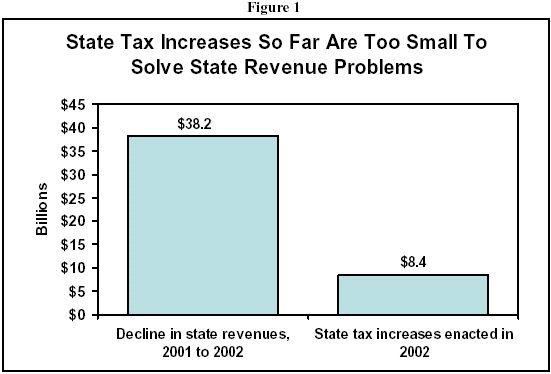

The State Tax Cuts Of The 1990s The Current Revenue Crisis And Implications For State Services 11 12 02

Taxes And Spending In Nebraska

5 Essential Steps To Reform Taxes In Nebraska

Nebraska Sales Tax Rate Changes January And April 2019

Taxes And Spending In Nebraska

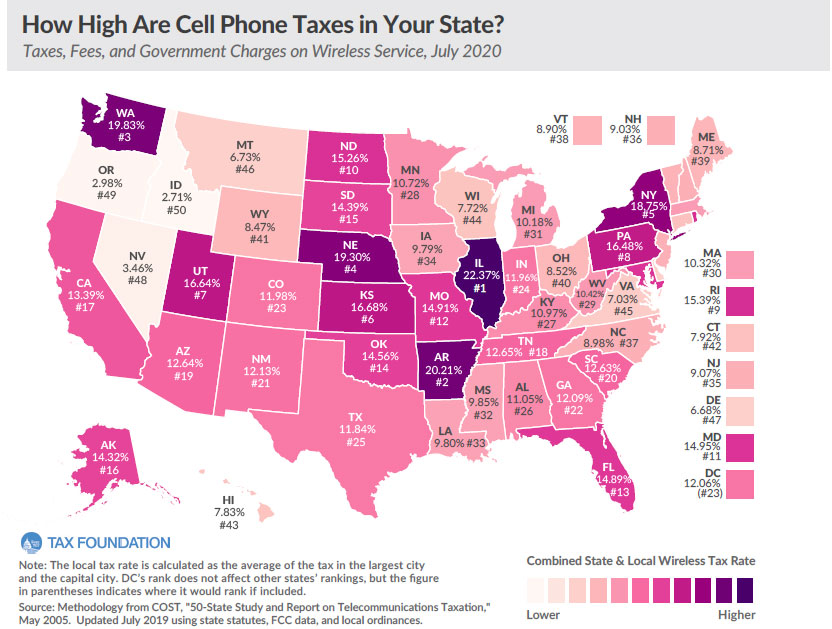

Nebraska Has 4th Highest Wireless Tax Burden In The Nation

The State Tax Cuts Of The 1990s The Current Revenue Crisis And Implications For State Services 11 12 02

With Revenue Growth Strong Iowa Nebraska Ohio And Wisconsin Legislatures Cut Income Taxes In 2021 Csg Midwest

What Is Sales Tax A Complete Guide Taxjar

Taxes And Spending In Nebraska

How High Are Cell Phone Taxes In Your State Tax Foundation

Nebraska Sales Tax Calculator And Local Rates 2021 Wise

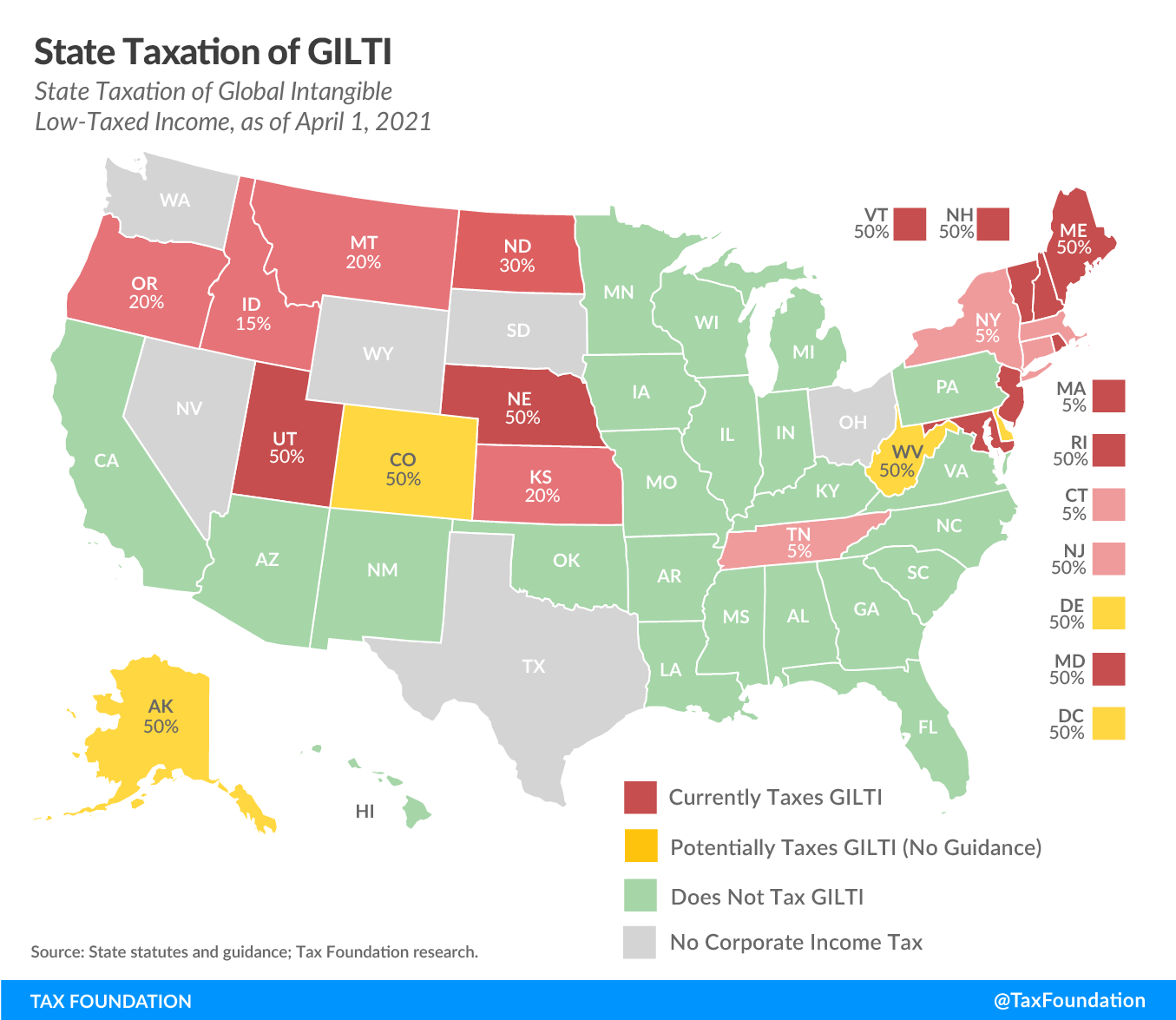

Nebraska Corporate Tax Bill Gilti And Corporate Rate Reduction

How Do State Estate And Inheritance Taxes Work Tax Policy Center